Bitcoin and Stock to Flow Model

January 31, 2020•478 words

Common sense tells us that scarce things are valuable or costly. Scarce things such as precious metals or antiques are especially costly because they are hard to create for anyone.

Nick Szabo calls this property of being costly to forge "unforgeable costliness". Unforgeable costliness provides value independently from 3rd parties. Monetary systems are based on objects that are naturally (precious metals) or artificially (fiat and accouting) unforgeably costly.

However we can't really pay with metal online. Worse, it is free to create bits online. To have digital money we need a technique to create bits online in a costly way.

This technique would ensure that the "bits" it produces will keep being scarce. These bits would become a suitable digital money.

No such technique had ever existed until Bitcoin: Bitcoin is a protocol - a "technique" - that produces at a high cost (electricity bill) bitcoins that can be used as digital money.

The relationship between unforgeable costliness and value can be demonstrated by the stock to flow model.

StockToFlow = SF = stock / flow = 1 / supply growth rate

Stock is the existing reserves at a given time. Flow is the yearly production, the yearly injection of new volumes of commodities.

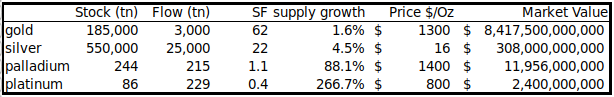

SF value of different commodities

For a commodities to increase its SF is very hard. As soon as individuals stockpile them, the offer and demand equilibrium will break and prices will rise. This will incentivize people to produce more of it (e.g mine more palladium). Prices will fall again.

So this property - "unforgeable costliness" - is essential.

Bitcoin SF model

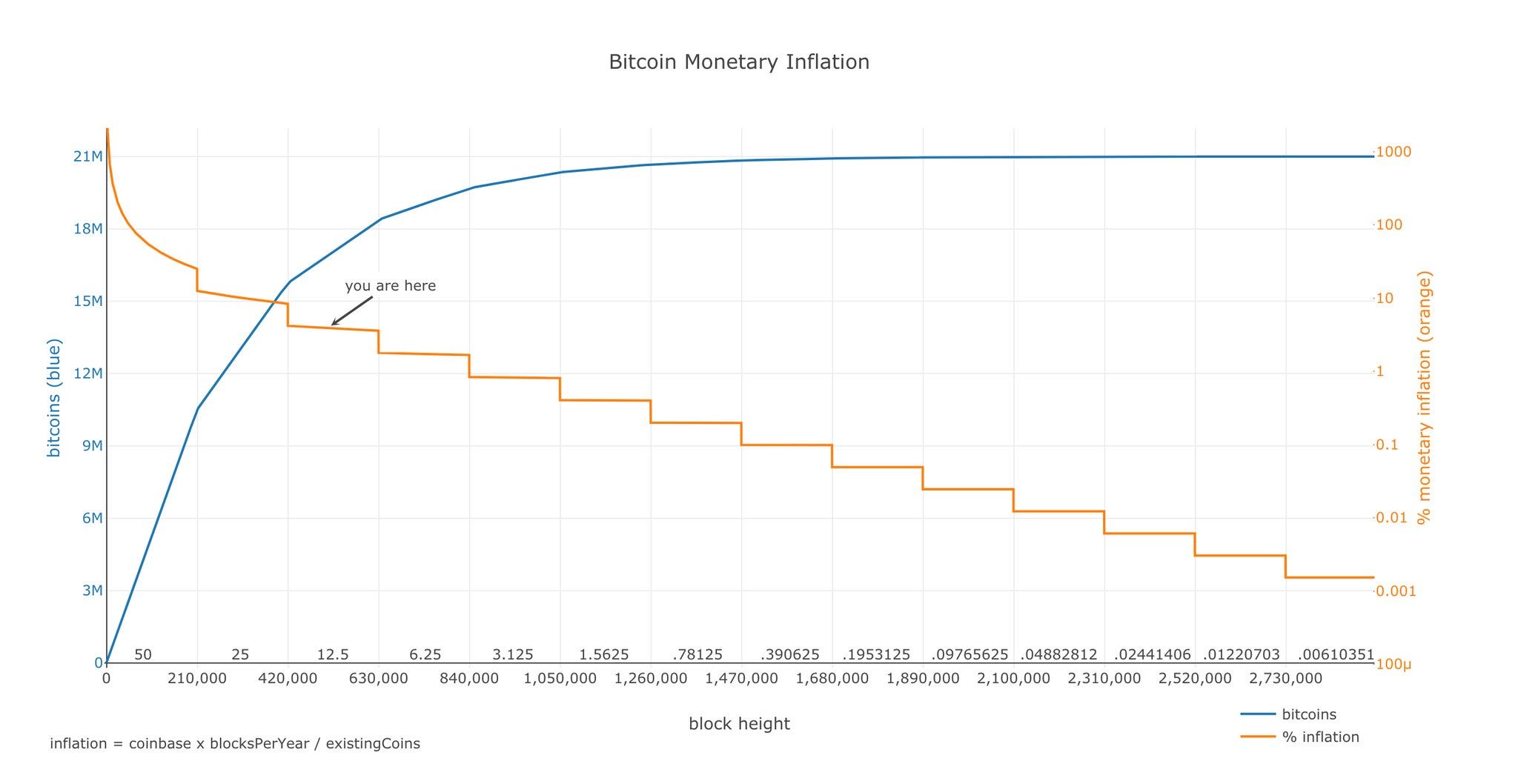

Bitcoin has a current supply of 18,1M coins and a supply of 0.7M/year.

SF = 18.7 / 0.7 = 26.7

This places Bitcoin gold and silver.

However the Bitcoin protocol is designed in such a way that:

- its maximal supply is fixed at 21M

- The supply of additional bitcoin is cut in half every ~4 years (every 210,000 blocks)

Is this model valid?

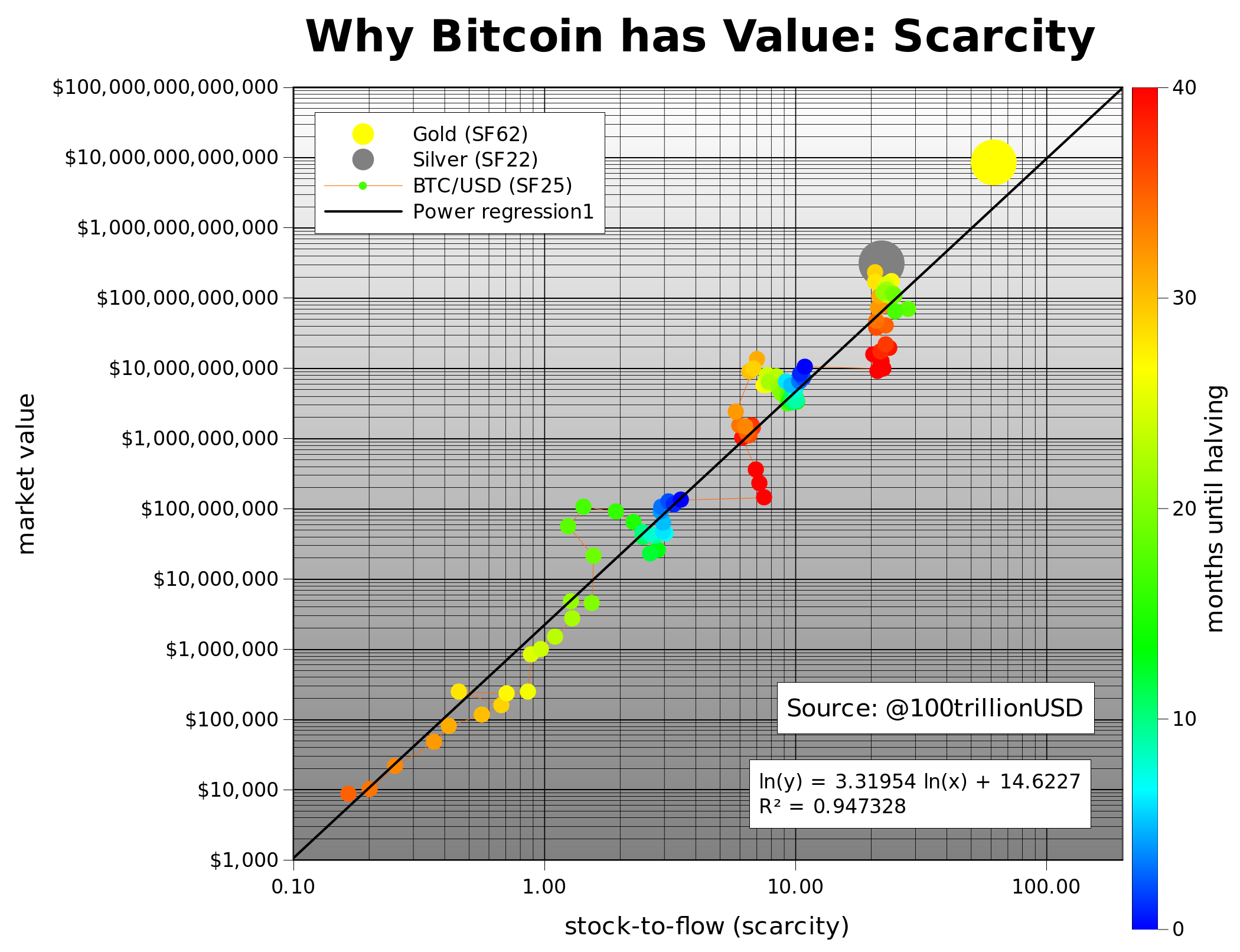

PlanB tested the hypothesis that scarcity, measured as SF, drives value.

For gold, silver and Bitcoin he:

- collected historical supply data. In Bitcoin's case, he queried the Bitcoin blockchain to know the number of new blocks (thus new bitcoins) per month.

- collected historical price data

Then he plotted SF vs market value (logarithmic axis).

There is a strong statistical relationship (R^2 ~ 95%) between SF and market value.

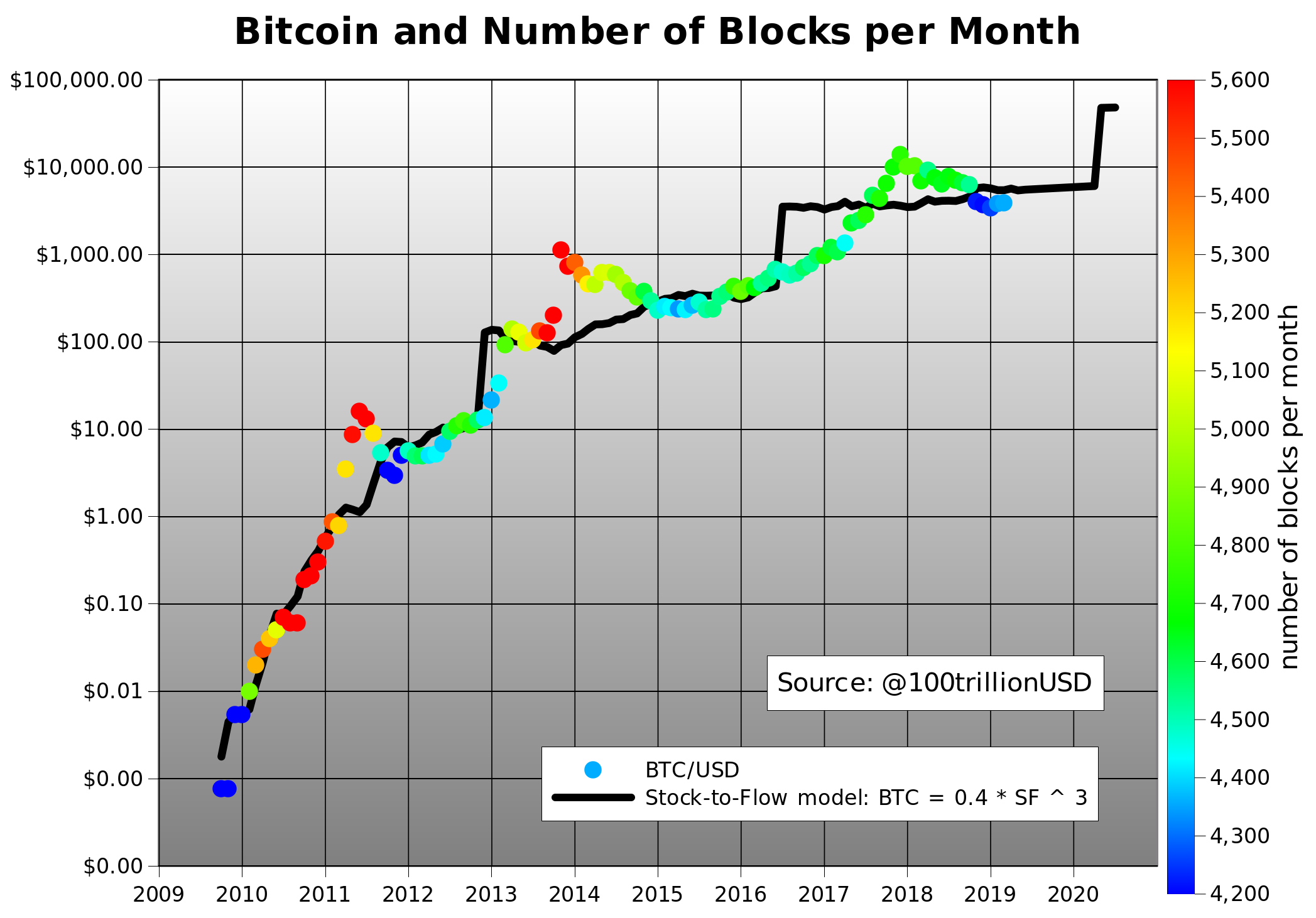

Can we use this model to predict Bitcoin future price?

Unlike gold, the evolution of Bitcoin's supply is known, because it is predefined by the protocol.

We then have a way to predict the evolution of Bitcoin's price.

The model predicts a bitcoin market value of $1trn after next halving in May 2020, which translates in a bitcoin price of $55,000.